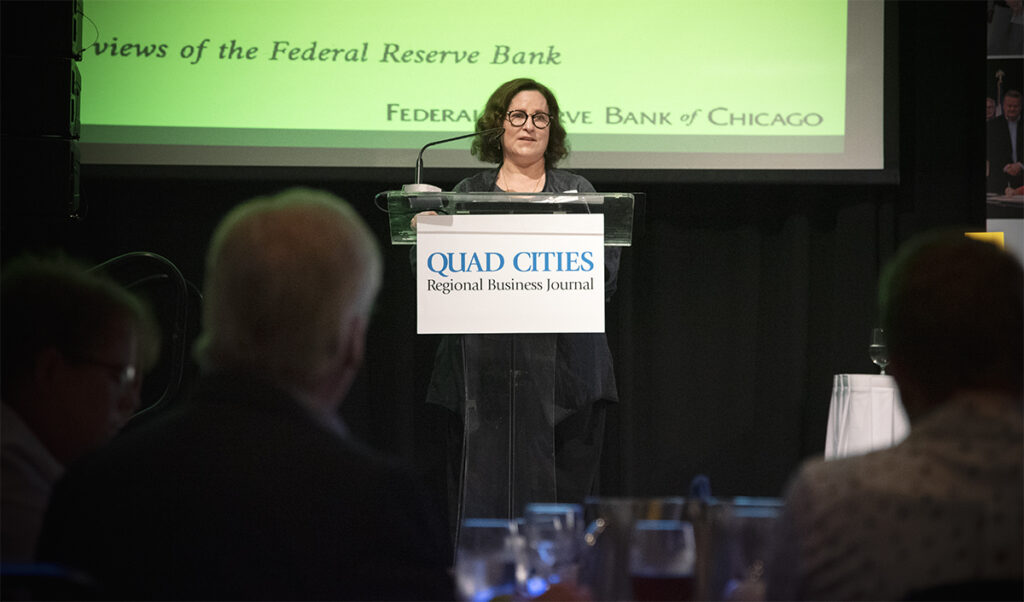

Chicago Fed analyst and researcher Ellen Rissman delivered the keynote at the QCBJ’s 2023 Mid-Year Economic Review on Thursday, June 22, at Bally’s Casino & Hotel, Rock Island. CREDIT JESSE CODLING

The Quad Cities has what it takes to succeed in a post-pandemic economy, Chicago Fed analyst and researcher Ellen Rissman told local business leaders at the QCBJ’s 2023 Mid-Year Economic Review.

The assistant vice president of business cycle analysis and communications also warned the crowd of nearly 200 attendees gathered Thursday, June 22, at Bally’s Casino & Hotel, Rock Island, to brace for the impact of…

Want to Read More?

Get immediate, unlimited access to all subscriber content and much more.

Learn more in our subscriber FAQ.

Do you want to read and share this article without a paywall?